Bytes and Bylines | Issue 1 | December 2024 Greetings from Grameen Foundation for Social Impact !Grameen Foundation for Social Impact (GFSI) is excited to invite you to explore our latest Bytes and Bylines as we approach the close of another remarkable year dedicated to fostering an inclusive and equitable society. At Grameen Foundation for Social Impact, we focus on addressing the challenges faced by low-income and marginalized communities. Our approach is based on a deep understanding of barriers to awareness, access, adoption, and quality. By engaging communities directly and leveraging scalable models, technology, and innovative partnerships, we tackle both demand and supply-side obstacles. Our solutions are designed for sustainability and long-term impact, enabling individuals and communities to overcome poverty and achieve lasting social and economic progress. This Bytes and Bylines highlights key milestones, ongoing initiatives, spotlight and vibrant community engagement from November and December, 2024. It also features perspectives from our program participants, showcasing the resilience and determination of women from marginalised communities breaking barriers and creating opportunities. We invite you to join us in celebrating these achievements and look ahead to the exciting journey as we step into 2025. With Best Wishes from GFSI |

|

INNOVATIONS IN DIGITAL FINANCE |

|

Expanding BC Networks and Driving Inclusive Growth

|

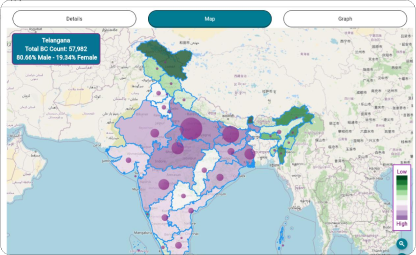

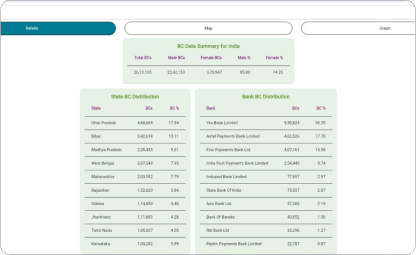

The Scaling Agent Viability and Quality in India program is enhancing the scalability, viability, gender sensitivity, and quality of Business Correspondent (BC) agent networks across India. We are expanding product offerings, improving liquidity management, increasing agent presence in underserved areas, and boosting women’s participation in BC networks. On November 12th, under the SCALES program, we conducted a Training of Trainers (ToT) session for 38 PayNearby sales managers and regional training managers. The training focused on integrating selling skills into BC businesses to help them expand beyond Cash In Cash Out (CICO) services and promote non-CICO products. Through engaging discussions, real-life examples, and interactive storytelling, we enabled participants to gain practical insights that will enhance their sales strategies and drive business growth. Efforts to strengthen the initiative are in full swing. The Morai team is developing a Geographic Information Systems (GIS) dashboard, set to be finalized by December 2024. This dashboard will improve data visualization and gender-focused analysis, mapping remote and underserved areas where banking services are limited or unavailable. This will help us identify potential locations and individuals to onboard as BC agents. We are also analyzing how capital support impacts BC agent’s incomes, with the findings set to culminate in a comprehensive knowledge product. We are also creating a module for the BCNM network playbook that emphasizes the importance of women’s involvement in BCN. Additionally, we are developing a project mascot, animations, and a comic book— all designed to foster greater engagement and awareness under the SCALES program. |

|

Innovative Solutions and eCommerce for Growth of Micro Enterprises and Business Correspondents

|

The "Testing Innovation in BC Channel" program aims to boost financial inclusion in rural and underserved communities. Building on the success of the Business Correspondent (BC) Model, it addresses challenges like limited credit access for women. Drawing from Grameen’s BEADS and SCALE initiatives, the program tests new products, services, and approaches to transform BC networks. Under the Innovations, we are driving significant progress. On November 14, we launched the Community of Practice (CoP) on the ECHO India platform, bringing together 40 members from 20 organizations. A CoP is a group of individuals who share a common interest or expertise and engage in regular interaction to learn from each other, collaborate on challenges, and advance their collective knowledge. Since then, our network has grown above 50 members on the ECHO India platform, and we are on track to reach our goal of 100 members. We have also initiated eCommerce pilots in the Kuberjee and CDOT areas, where Micro Entrepreneurs (MEs) and Business Correspondents (BCs) are actively involved. We are onboarding sellers and have selected EasyPay as the Seller Network Provider (SNP) in Kuberjee. Through field visits to almost 50 women MEs, we identified both the challenges they face and the opportunities available for growth. As part of this effort, we conducted orientation training on the ONDC network for the selected MEs. Additionally, we have signed an MoU between EasyPay (SNP) and BCNMs to facilitate the onboarding of MEs onto the ONDC platform. The MEs and BCNMs have been identified through collaboration with Kuberjee and CDOT. At the Global Inclusive Finance Summit 2024 on December 11-12, we showcased our work, connecting with other organizations in the field. On December 12, we hosted a panel discussion titled "What a Decade of JAM Has Achieved for Women: Challenges and the Way Ahead," moderated by Saurabh Singh, Senior Project Manager at GFSI. The panel featured experts like Dr. Pawan Bakhshi (Bill & Melinda Gates Foundation), Kalpana Ajayan (Women’s World Banking), Akhand Tiwari (MSC), Kalyanaraman A. (Varashakti Housing Finance), and Arindam Dasgupta (Senior Director- Program Operations & Strategy, Grameen Foundation for Social Impact). The discussion focused on the impact of Jan Dhan, Aadhaar, and Mobile (JAM) on improving financial inclusion for women, while also addressing challenges such as the gender digital divide. The panel highlighted how technology can enable women, and the role of tailored financial solutions based on transaction data. Our team continues to make strides in Innovations. We have successfully onboarded 112 MEs through Kuberjee in Surat and identified key clusters and BCs. We are finalizing an MoU between EasyPay (SNP) and Kuberjee (BCNM), and a similar agreement with CDOT and EasyPay is also in the works. Our team recently visited EasyPay in Pune, Kuberjee in Surat, and CDOT in Patna, engaging directly with field teams and MEs to better understand the challenges they face. Additionally, we are developing knowledge products that focus on gender inclusion and digital finance, and hosting a webinar series on topics like "Innovations in the Business Correspondent Industry: Challenges, Solutions, and Pathways to Sustainability." This ongoing work is shaping the future of inclusive finance and digital innovation.

For more details, click here |

Suggestions from Micro Enterprises and Business Correspondents

Increase IncomeAn increase in income is desired through offering more services, selling local products, and leveraging platforms like ONDC. These strategies aim to diversify revenue streams and attract a wider customer base.

|

Enhancement of Customer EngagementStronger customer engagement is sought by building better relationships through personalized services and improved communication. This approach focuses on fostering loyalty and encouraging repeat business.

|

Expansion of Market ReachAn expansion of market reach is aimed for by better product portfolio, utilizing online channels and digital tools to target a larger audience and increase visibility, especially in untapped areas.

|

Innovations in Digital Finance

Sector Highlights

LIC’s Bima Sakhi Initiative is Launched: The Government of India has introduced the Bima Sakhi initiative, aiming to promote financial literacy and provide women with opportunities to enhance their economic participation. |

Dar Certification Updates: Significant progress has been made in Dar certification, ensuring improved standards and streamlined processes across the sector.

For more info |

Agriculture and Livelihood Practices |

|

Enabling Agri-Entrepreneurs to Drive Sustainable Farming and Boost Economic Growth

|

The Generating Rural Opportunities for Women Agri-entrepreneurship (GROW) program aims to enable 5,000 women as Agri-entrepreneurs across four districts of Andhra Pradesh (East Godavari, West Godavari, Krishna, and Visakhapatnam). Over 5 years, the initiative will enhance livelihoods for 1 million smallholder farmers by developing agricultural value chains and using technology for training and capacity building. In GROW, we have successfully created 300 Agri-Entrepreneurs (AEs), with 92 of them actively providing essential services to Smallholder Farmers (SHFs). The initiative has engaged 2,550 SHFs, generating transactions worth ₹32.41 lakhs. These include 15MT of cashew sold for ₹22.89 lakhs, 63MT of banana for ₹5.08 lakhs, and 10.095MT of vegetables valued at ₹3.069 lakhs. We have also conducted six training sessions, equipping Agri-Entrepreneurs (AEs) with essential skills in business management, financial literacy, and customer engagement. They learned inventory control, market linkages, and crop-specific knowledge using the PlantwisePlus factsheets App for diagnosing plant diseases and managing pests. The Grameen Kisaan Connect App has allowed them to interact directly with farmers, understand market demand, and adapt their businesses to increase profitability. In West Godavari, Andhra Pradesh, 19 women agri-entrepreneurs completed a 26-day residential training on agri-entrepreneurship development, organized in partnership with Syngenta Foundation India and CCS-NIAM. Upon completion, they received graduation certificates, enabling them to obtain input licenses, set up agricultural input centers, provide advisory services, and drive agri-entrepreneurship in their communities, creating sustainable livelihoods and promoting a more equitable agricultural ecosystem. Looking ahead, we have planned advanced training for 35 AEs, focusing on nursery and grafting management in December 2024. Our research efforts are also progressing, with the baseline survey and value chain analysis for East and West Godavari completed and the final report currently in development. |

|

From June 2023 to December 2024, partner FPOs of MANDI II achieved ₹12.70 Cr turnover, driven by strengthened access, increased women’s leadership ans participation across 38 FPOs.

|

The Market Access eNabled by Digital Innovation (MANDI II) initiative, enables Farmer Producer Organizations (FPOs) to improve market access, financial inclusion, and resilience for smallholder farmers, particularly women. The program focuses on enhancing market linkages, promoting digitization, enabling gender equality, and improving access to finance and technology. We made significant progress in the MANDI II program, generating a ₹12.70 Cr turnover across 38 Farmer Producer Organizations (FPOs). We have forged new partnerships with Ayekart and Mother Dairy, and we have begun exporting chili to Bangladesh. Women's participation has grown, with 2,492 women now serving as shareholders, raising their representation to 42.7%, and occupying 33.2% of Board of Directors positions. We have secured financial linkages totaling ₹8.7 Cr for 15 FPOs, including a ₹10 lakh loan for Banaras Organo FPCL. We hosted a Buyer-Seller Meeting that connected FPO representatives with market leaders, NBFCs, banks, and logistics providers. This meeting facilitated partnerships, knowledge exchange, and actionable strategies, strengthening market access and financial opportunities for smallholder farmers.

We also conducted a Digital Literacy & AgTech Solutions Workshop on November 13–14 in Varanasi, where 98 participants from 47 FPOs in Eastern UP and West Bengal gained valuable skills.

These workshops enabled FPO members with digital skills, improving their operations, market access, and collaboration for sustainable growth. On December 17th, we hosted a successful Buyer-Seller cum Stakeholders' Meet 2024, bringing together a diverse group of industry leaders

This event served as a platform for FPOs to access markets, form new business partnerships, and engage in discussions about market trends and quality standards. We look forward to leveraging these relationships for continued growth and innovation in the agricultural sector. The program is promoting gender inclusion and technological adoption by training 367 women farmers across 10 FPOs and conducting Power Weeder demonstrations for 520 women. We have also established compost units across all 10 Hub-and-Spoke FPOs, with six actively selling compost fertilizers locally. Furthermore, 100 FPO members are using the Aye Krishi Tech platform to make data-driven decisions, fostering sustainable growth and stronger market linkages.

For more details, click here |

Agriculture and Livelihood Practices

Sector Highlights

The Ministry of Agriculture and Farmers Welfare has been allocated Rs 1,32,470 crore, making up 2.7% of the total central government budget. This marks a 5% increase from last year's revised estimate, signaling a strong commitment to strengthening the sector.

For more info |

A major boost to agricultural innovation with the release of 109 new high-yielding and climate-resilient varieties across 32 field and horticulture crops. These varieties will help farmers adapt to changing climate conditions and increase productivity. |

The government is set to initiate 1 crore farmers into natural farming over the next two years, offering certification and branding to support sustainable agricultural practices. |

The government plans to roll out Digital Public Infrastructure (DPI) over the next three years. This initiative will cover farmers and their lands, creating a digital backbone to enable farmers with real-time information and services.

For more info |

Advancing Women’s Entrepreneurship |

|

Lakshyavati Program is Enabling Girls to Complete their Education

|

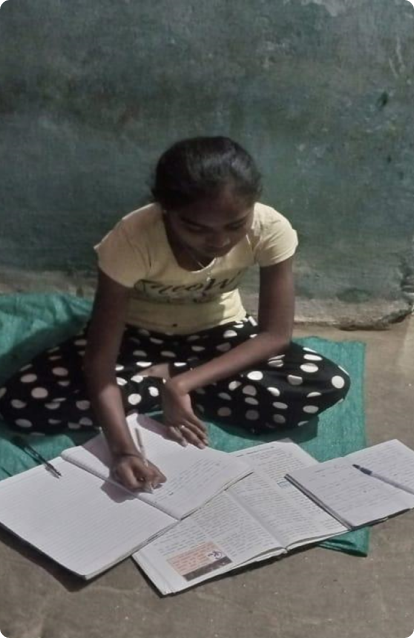

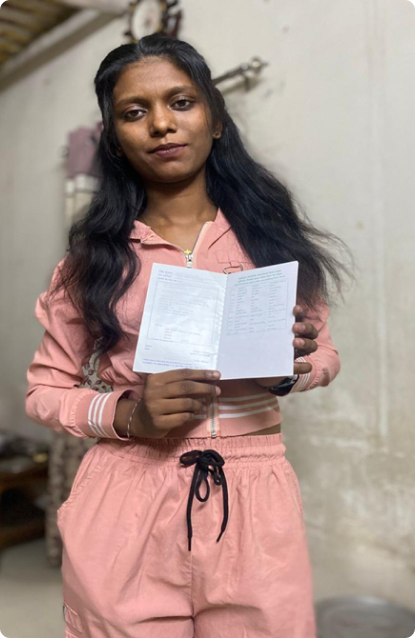

Lakshyavati is a program focused on enabling underprivileged girls (grades 7-12) from underserved districts in Maharashtra to improve their educational attainment and reduce school dropout rates. Under this program, we distributed physical passbooks to all the girls, ensuring better financial control. All the girls successfully passed their first-term exams this session, demonstrating academic excellence. Our Block Coordinators provide individual counseling sessions to 150 girls across Bhandara and Nagpur, helping them manage exam pressures effectively.

Additionally, we have completed data collection on the aspirations of the girls who have graduated, and we are now conducting trend analysis to guide future initiatives. |

|

Women Financial Service Providers as Agents of Change

|

Under the Women as Agents of Change and Economic Empowerment (W-ACE) program, we are building the entrepreneurial capacity of 650 Grameen Mittras—female agents who provide marginalized households with doorstep access to a variety of financial products and services via a digital platform. Through this initiative, we aim for these Mittras to reach over 150,000 end clients, offering financial education, digital financial literacy, and a range of financial and digital payment services.

Through the W-ACE program, we continue to guide the Mittras on how to effectively use PayNearby and boost offline product sales, ensuring steady growth despite seasonal challenges. |

Boosting Investment Readiness & Digital Transformation Of Women-Led Small Businesses

|

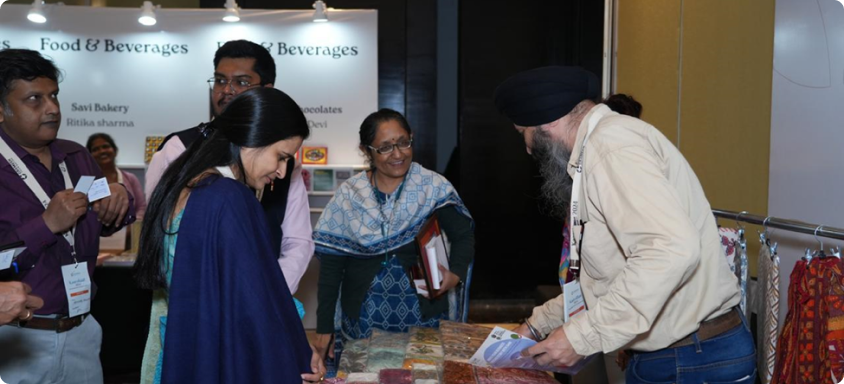

Investment Readiness & Digital Transformation Of Women-Led Small Businesses (IRDT-WSB) focuses on enabling women entrepreneurs by fostering investment readiness and driving digital transformation within early-stage, women-owned small businesses. It aims to support the growth of 300 women-owned businesses in the Delhi NCR region, offering training, mentoring, and capacity-building initiatives to help these entrepreneurs thrive in the MSME ecosystem. Recently, IRDT organised Kaarobaar 2024 that made significant strides in supporting women-owned small businesses (WSBs) by connecting them with buyers, sellers, and lenders. This Buyer-Seller-Lender meet fostered collaborations with government institutions, marketplaces, and enterprise support organizations (ESOs) to provide visibility and growth opportunities for women entrepreneurs. This led to-

Impact

Currently, in IRDT, we are actively supporting women-owned small businesses (WSBs) through various initiatives:

For more details, click here |

|

Kaarobaar 2024 from the lens of Women Entrepreneurs

|

I am truly thankful for the opportunity to be part of ‘Kaarobaar 2024.’ It was an inspiring and insightful event that celebrated women entrepreneurs. The sessions, connections, and chance to showcase our products meant a lot to me. Thank you for supporting and encouraging our journey. -Harcharan Kaur (Kaur’s Kraft Global)

|

The ‘Kaarobaar 2024’ session was truly inspiring and has brought us closer to achieving our dreams. I am deeply grateful to the Grameen Foundation Team for creating such opportunities for women entrepreneurs. Looking forward to future collaborations! -Lovely Jain (ALLAPS1728Boutique)

|

Advancing Women’s Entrepreneurship

Sector Highlights

Special Campaign 4.0 by Ministry of MSME

For more info |

Amazon Smbhav 2024 Announcements

For more info |

Credit Guarantee Scheme for Manufacturing MSMEs

For more info |

Grameen Foundation India News

Grameen Foundation India (GFI) is a for-profit organization that provides advisory services to organizations focused on improving the lives of underserved communities. We specialize in research, data collection, monitoring, and the application of easy-to-understand beneficiary-level data to enhance the impact of our partners. By collaborating with government entities, international institutions, and civil society organizations, including NGOs, philanthropic foundations, and corporations, we help drive sustainable, positive change.

|

As part of the AgriPath project's Engagement Hub activities (EH05), a two-day capacity building workshop on basic gender concepts was successfully conducted on December 17th (For Varanasi District) and 18th (For Mirzapur District), 2024, at Hotel Kesari Palace, Varanasi. This training aimed to deepen the knowledge of extension agents on gender dynamics within agricultural contexts and promote the integration of gender responsive approaches in their advisory services. The workshop hosted 39 male and female extension agents on Day 1 of Varanasi District and 40 on Day 2 of Mirzapur District, achieving a combined total of 79 participants. Key sessions included:

The interactive format facilitated deeper insights into the gender-based impacts on farming practices, decision-making, and resource accessibility. Feedback from participants indicated an enhanced understanding of gender dynamics and greater confidence in applying gender-inclusive approaches in their advisory services. Expected Outcomes Achieved:

|

|

|

AgriPath organized its third annual in-person workshop in Varanasi from October 21–25, 2024, bringing together all consortium partners. These included the Centre for Development and Environment (CDE) at the University of Bern, Grameen Foundation USA (GFUSA), Grameen Foundation India (GFI), International Centre of Insect Physiology and Ecology (ICIPE), and Farmbetter, alongside host organizations iDE Nepal, Kathmandu University, Kilimo Trust (Uganda and Tanzania), and Semus (Burkina Faso). The workshop served as an intensive platform for participants to assess the progress made over the past year, develop a strong framework for scaling activities, and formulate strategic plans for the year ahead. Representatives from key donors, including the Swiss Development Corporation (SDC), Farmbetter, and GIZ, also participated, further enriching the discussions. |

|